vermont income tax refund

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Vermont assesses state income tax on its residents using a joint filing system.

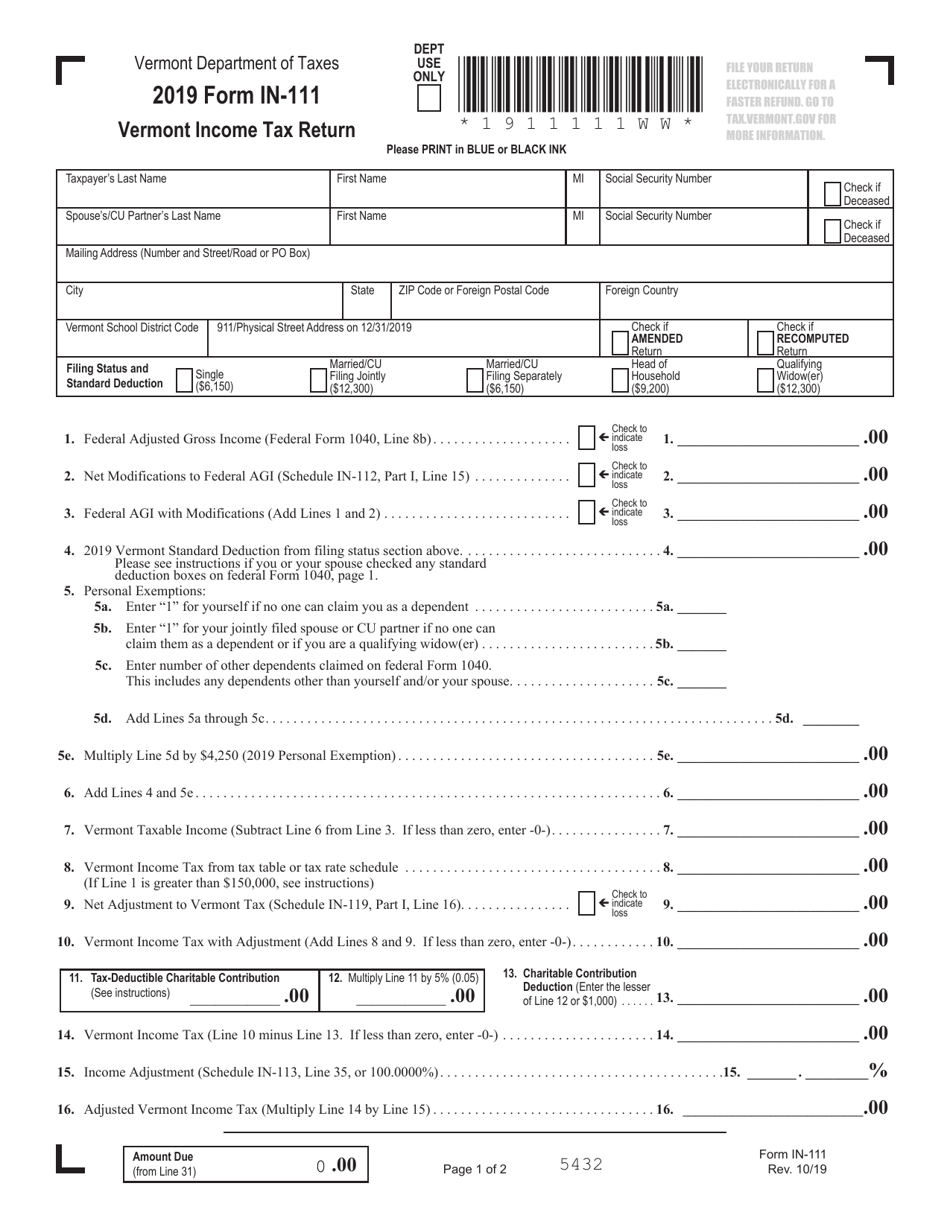

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Its top rate however is.

. If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference. If you have further. Tracking your Vermont tax refund.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. Vermont Personal Income Tax Return Form IN-111 DEPT USE ONLY Vermont Department of Taxes 2021 Form IN-111 Vermont Income Tax Return 211111100 2 1 1 1 1 1 1 0 0 Please PRINT in BLUE or BLACK INK FILE YOUR RETURN ELECTRONICALLY FOR A FASTER REFUND. Adoption of federal income tax laws Section 5824 shall apply to taxable years beginning on and after January 1 2021 5825.

Like many other states Vermonts state income tax is progressive. AUDITORVERMONTGOV WWWAUDITORVERMONTGOV DOUGLAS R. In doing so Vermont adheres to the idea that a family is a single economic unit and should be taxed as such.

The process time for e. To check the status of your return you should wait at least 72 hours for an electronically filed return and four or more weeks for paper filings. Any tax liability in excess of withholding must be paid by the seller with the return.

After calculating your income tax liability you may be able to claim some credits to reduce your tax bill or increase your refund. File or Pay Online. However if the fiduciary files the return after 60 days without obtaining an extension the estate is subject to a late filing penalty even if there is no tax due or a refund on the late return.

31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment. Estates and Fiduciaries - A fiduciary is allowed to file a Vermont income tax return up to 60 days after the original due date without an extension. Department of Taxes Check Return or Refund Status No.

A Vermont Income Tax Return must be filed within the time prescribed for filing the federal income tax return. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff 802 828-2505 Department Directory. Understand and comply with their state tax obligations.

16-05 debt to the Department of Taxes for offset against personal income tax refunds and homestead property tax income sensitivity adjustments. Please wait at least three days before checking the status of your return on electronically filed returns and six to eight weeks for paper-filed returns. Name of tax 5822.

Vermont Individual Income Tax Provisions. As a result ESD is losing opportunities to recoup additional improper payments. GO TO TAXVERMONTGOV FOR MORE INFORMATION.

Use a tax professional or volunteer assistance to prepare and file your return. Separate taxes such as Income and Property Tax are assessed against each taxpayer meeting certain minimum criteria. HOFFER Vermont State Auditor 2 September 12 2016 Rpt.

It is the same as the IRS deadline for filing federal income tax returns. Vermont State Income Tax Return forms for Tax Year 2021 Jan. VT Department of Taxes PO Box 1779 Montpelier VT 05601-1779.

ACH Debit free Credit card 3 nonrefundable fee. You may pay your income tax estimated income tax and any Vermont tax bill online using one of the following. However be aware that not paying Vermont income tax by the due date means youll face interest and penalties and other consequences like tax liens debt collection or even garnishment of your wages.

By Timothy McQuiston Vermont Business Magazine Secretary of Administration Kristin Clouser today released Vermonts revenue results for February which showed a steep decline in personal income tax receiptsThe PI is the most important General Fund revenue source. Find out when your Vermont Income Tax Refund will arrive. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

Tax on income of individuals estates and trusts 5823. FY2022 Property Tax Rates. Directory of Federal Tax Return Preparers.

If this date falls on a weekend or a holiday returns are due the following business day. VT Department of Taxes PO Box 1881 Montpelier VT 05601-1881 If you owe money to state include a check payable to VT Department of Taxesand send the check or money order along with the other tax forms. Vermont income taxes are imposed on individuals and entities taxpayers that vary with the profitable income taxable income of the taxpayer.

You can track your Vermont state tax refund using myVTax the Vermont Department of Taxes online system. Then click Search to find your refund. Up to 50 cash back Vermont State Tax Filing Deadline Vermont income tax returns are due on April 15th.

Paying Tax Owed On Your Income Tax Return. If you are receiving a refund or have no taxes due send your tax return. Click on Check the Status of Your Return Personal Income Tax Return Status.

Want to know how to authorize someone to prepare and file a tax return on your behalf. Go to myVTaxvermontgov to review the 2021 tax payments the Department has on record for you. If you were required to file a federal tax return in 2019 made more than 100 in income generated in Vermont or earned more than 1000 in taxable income you are required to file a Vermont resident.

Vermont income of individuals estates and trusts 5824. If your permanent residence was in Vermont or you lived in Vermont for more than 183 days then you are a Vermont resident. Credit for taxes paid to other states and provinces 5825a.

This method allows married couples to combine their income into a single amount which is then taxed. Credits available to individuals in Vermont include the Credit for Child Dependent Care Expenses the Elderly or Permanently Totally Disabled Tax Credit and the Earned Income Tax Credit EITC. Any excess withholding will be refunded to the seller by the Vermont Department of Taxes.

She suggested that this could be a net number reflective of early tax refunds. Enter the amount of 2021 Vermont estimated income taxes you paid the amount paid with Form IN-151 Extension of Time to File the 2021 return and any 2020 Vermont refund credited towards your 2021 taxes.

Vermont Tax Forms And Instructions For 2021 Form In 111

Vermont S Tax System Is Still Unfair Public Assets Institute

Vermont Income Tax Vt State Tax Calculator Community Tax

Personal Income Tax Department Of Taxes

File Vermont Income Taxes Get A Fast Tax Refund E File Com

Reminder U S And Vermont Income Taxes Must Be Filed By May 17

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Understanding Your Tax Bill Department Of Taxes

Personal Income Tax Department Of Taxes

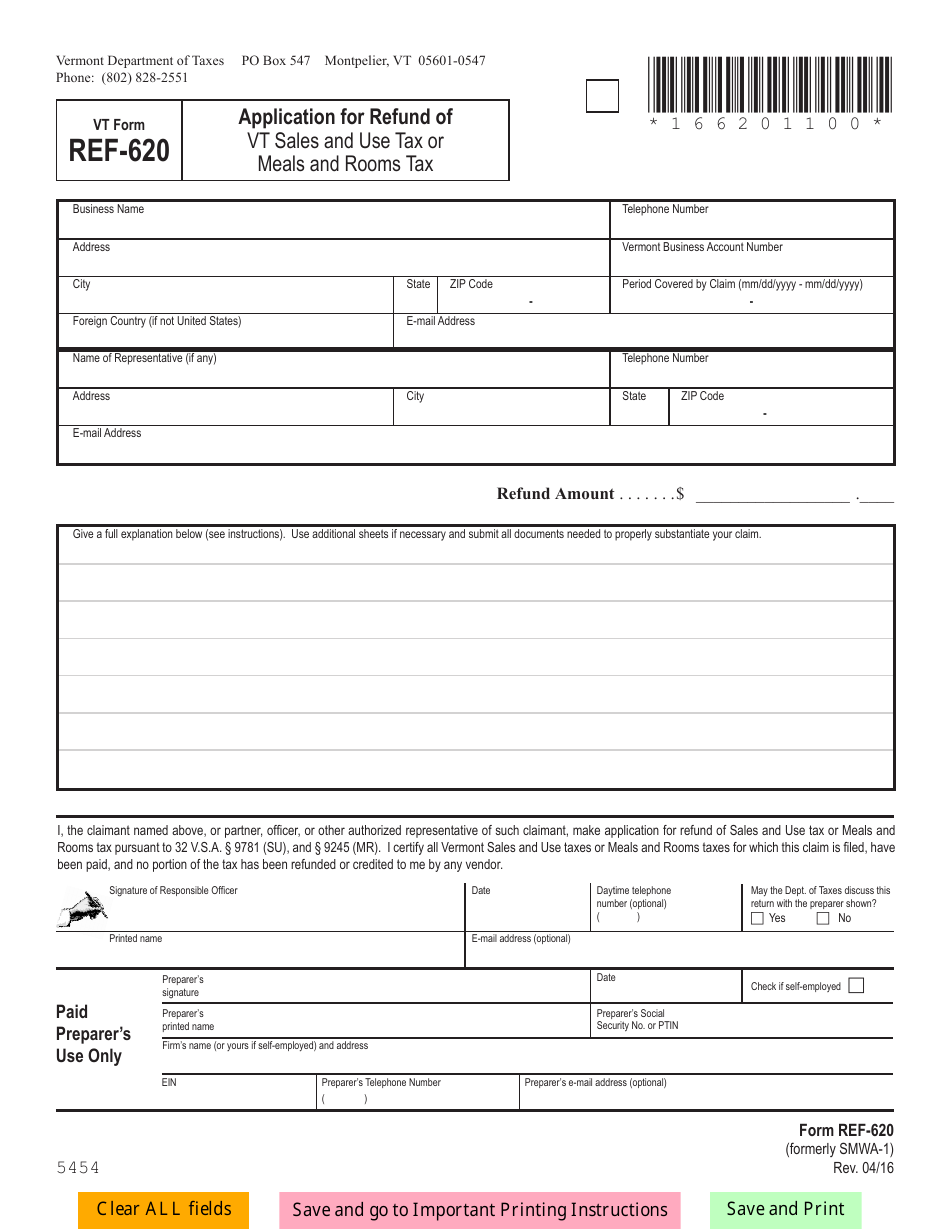

Vt Form Ref 620 Download Fillable Pdf Or Fill Online Application For Refund Of Vt Sales And Use Tax Or Meals And Rooms Tax Vermont Templateroller

Where S My Refund Vermont H R Block